Can you cancel claim car insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with formal and friendly language style and brimming with originality from the outset.

When it comes to car insurance claims, understanding the process of cancellation, the necessary steps, and alternatives can be crucial. This guide delves into the intricacies of canceling car insurance claims to provide you with a comprehensive understanding of your options.

Understanding Car Insurance Claims Cancellation

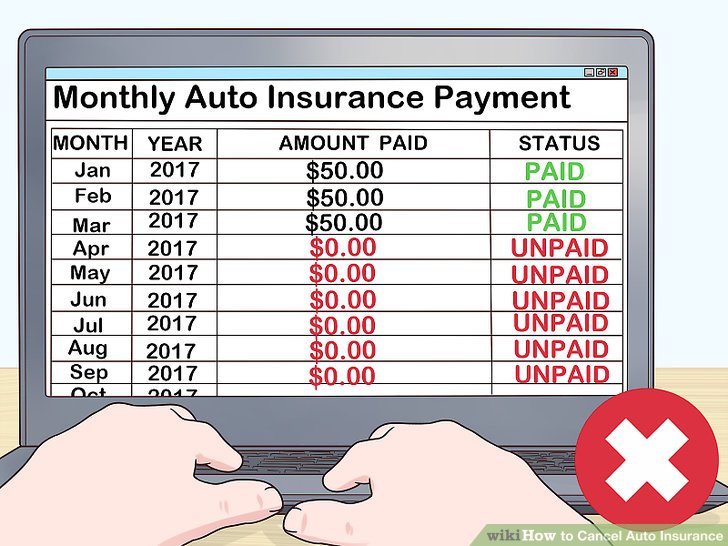

Car insurance claims cancellation is the process of withdrawing or revoking a claim that has been submitted to an insurance company for reimbursement. There are specific reasons why someone might want to cancel a claim, such as realizing that the damage is not covered by the policy or deciding to pay out of pocket instead. However, canceling a claim can have implications on future coverage and premiums.

Steps to Cancel a Car Insurance Claim

To cancel a car insurance claim, policyholders typically need to contact their insurance provider directly and request the cancellation. Depending on the insurance company, there may be specific forms or documentation required to formalize the cancellation process. It’s essential to adhere to any deadlines or timeframes set by the insurer when canceling a claim to avoid complications.

Alternatives to Canceling Car Insurance Claims, Can you cancel claim car insurance

Instead of canceling a car insurance claim, policyholders can explore alternatives such as adjusting the claim amount, modifying the coverage details, or negotiating with the insurance company for a different resolution. These alternatives may impact premiums and coverage differently, so it’s crucial to weigh the options carefully before making a decision.

Legal Aspects and Regulations

When canceling car insurance claims, policyholders should consider any legal implications or regulations governing the process. It’s essential to be aware of your rights as a policyholder and understand the terms and conditions of your insurance policy related to claim cancellations. Seeking legal advice or consulting with an insurance professional can provide clarity on the legal aspects of canceling a car insurance claim.

Final Wrap-Up

In conclusion, navigating the terrain of canceling car insurance claims requires careful consideration of the process, steps, and potential alternatives. By arming yourself with knowledge about the implications and regulations involved, you can make informed decisions that best suit your needs.

Commonly Asked Questions: Can You Cancel Claim Car Insurance

Can I cancel my car insurance claim?

Yes, you can cancel your car insurance claim. Understanding the process and implications is crucial.

What are the steps involved in canceling a car insurance claim?

The specific steps include notifying your insurer, providing necessary documentation, and adhering to any deadlines.

Are there alternatives to canceling a car insurance claim?

Yes, alternatives include modifying or adjusting the claim instead of canceling it.

What legal aspects should I consider when canceling a car insurance claim?

Legal considerations include understanding relevant regulations and your rights as a policyholder.