Errors and omissions insurance for bookkeepers plays a crucial role in safeguarding their businesses from potential risks and financial losses. Let’s delve into the specifics of this essential insurance coverage.

This insurance provides protection in cases where mistakes or negligence could lead to legal action or financial repercussions, offering peace of mind to bookkeepers as they navigate their professional responsibilities.

Overview of Errors and Omissions Insurance for Bookkeepers

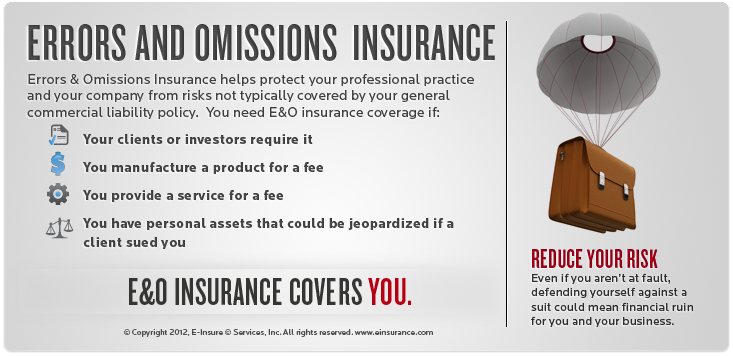

Errors and omissions insurance, also known as professional liability insurance, is designed to protect bookkeepers from financial losses due to mistakes or negligence in their work. This type of insurance provides coverage for legal fees, settlements, and judgments that may arise from claims of errors or omissions in the services provided by bookkeepers.

Purpose of Errors and Omissions Insurance, Errors and omissions insurance for bookkeepers

Errors and omissions insurance helps bookkeepers cover the costs associated with defending themselves against claims of professional negligence, errors in work, or failure to deliver services as promised. It offers financial protection and peace of mind to bookkeepers in case clients file lawsuits or complaints against them.

Types of Risks Covered

Errors and omissions insurance typically covers claims related to errors in financial statements, failure to meet deadlines, breaches of confidentiality, or inaccuracies in tax filings. For example, if a bookkeeper makes a mistake in a client’s tax return that results in financial penalties, their errors and omissions insurance would cover the costs of rectifying the error.

Importance of Errors and Omissions Insurance

Errors and omissions insurance is crucial for bookkeepers as it provides protection against potential financial losses that may arise from mistakes or oversights in their work. Unlike general liability insurance, which covers bodily injury and property damage, errors and omissions insurance specifically addresses claims of professional negligence in the services provided by bookkeepers.

Comparison with General Liability Insurance

While general liability insurance covers bodily injury and property damage, errors and omissions insurance focuses on claims related to professional services. Bookkeepers need both types of insurance to have comprehensive coverage and protect themselves from various risks associated with their profession.

Financial Protection

Errors and omissions insurance can protect bookkeepers from financial losses by covering the costs of legal defense, settlements, or judgments resulting from claims of errors or negligence. This insurance ensures that bookkeepers can continue their business operations without the fear of facing significant financial burdens due to lawsuits or complaints.

Coverage Details

Errors and omissions insurance typically covers legal defense costs, settlements, and judgments resulting from claims of errors, negligence, or failure to deliver services as promised. However, it may not cover criminal acts, intentional wrongdoing, or punitive damages. Bookkeepers should carefully review their policy to understand the specific coverage details and any exclusions.

Common Exclusions

Exclusions in errors and omissions insurance policies may include claims arising from dishonesty, fraud, criminal acts, or intentional violations of laws. It’s essential for bookkeepers to be aware of these exclusions to ensure they have adequate coverage for potential risks in their profession.

Limits and Deductibles

Errors and omissions insurance policies have coverage limits that specify the maximum amount the insurance company will pay for a claim. Bookkeepers should consider the limits and deductibles when selecting a policy to ensure they have sufficient coverage in case of a claim.

Cost and Considerations

The cost of errors and omissions insurance for bookkeepers is determined based on factors such as the size of the business, the services provided, the coverage limits, and the deductible chosen. Bookkeepers can lower their insurance premiums by implementing risk management practices, maintaining accurate records, and investing in ongoing professional development.

Factors to Consider

When selecting an errors and omissions insurance policy, bookkeepers should consider factors such as the coverage limits, deductibles, exclusions, and premium costs. It’s essential to choose a policy that aligns with the specific risks faced in the bookkeeping profession and provides adequate protection against potential claims.

Claims Process: Errors And Omissions Insurance For Bookkeepers

The process of filing a claim under errors and omissions insurance involves notifying the insurance company, providing documentation of the claim, and cooperating with the claims adjuster throughout the investigation. Bookkeepers should handle situations where clients accuse them of errors or negligence by documenting the facts, communicating with the client, and seeking legal advice if necessary.

Role of the Insurance Company

The insurance company plays a crucial role in investigating and processing claims under errors and omissions insurance. They will review the facts of the claim, assess the coverage, and determine the appropriate course of action to resolve the claim. Bookkeepers should work closely with the insurance company to ensure a timely and fair outcome in the claims process.

Closure

In conclusion, errors and omissions insurance for bookkeepers is a vital tool in mitigating risks and ensuring long-term success in their industry. By understanding the coverage details and importance of this insurance, bookkeepers can protect their businesses and reputation effectively.

Essential FAQs

What does errors and omissions insurance for bookkeepers cover?

Errors and omissions insurance typically covers legal fees, settlements, and judgments that arise from claims of professional negligence or mistakes.

How does errors and omissions insurance differ from general liability insurance for bookkeepers?

While general liability insurance covers bodily injury and property damage claims, errors and omissions insurance specifically protects against claims of professional errors or negligence.

Can bookkeepers lower their errors and omissions insurance premiums?

Bookkeepers can potentially lower their premiums by maintaining a clean claims history, implementing risk management practices, and choosing higher deductibles.

What steps are involved in filing a claim under errors and omissions insurance?

The process typically involves notifying the insurance company, providing necessary documentation, and cooperating in the investigation of the claim.