Lafayette TN Insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and importance. From its historical roots to the various coverage options available, this topic delves into the world of insurance in Lafayette, TN with a focus on clarity and relevance.

Overview of Lafayette TN Insurance

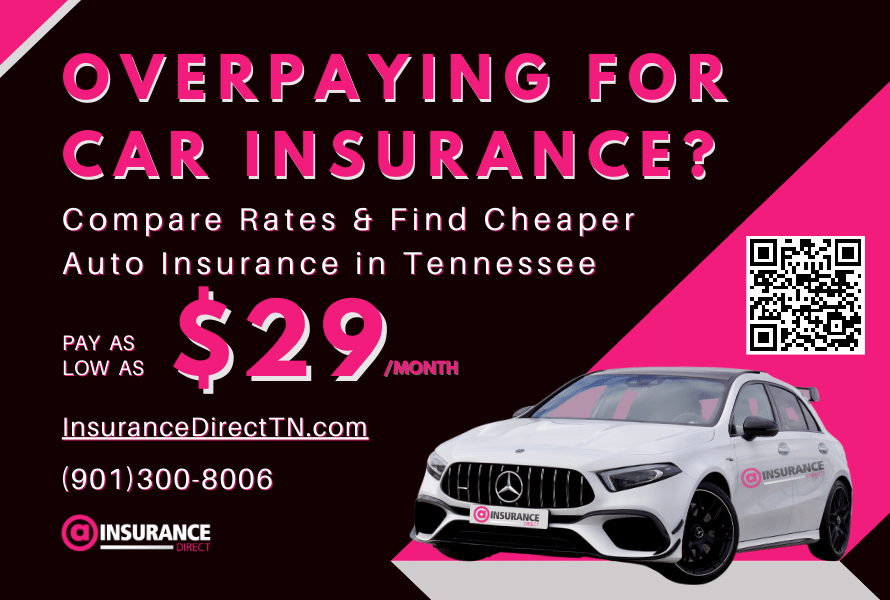

Insurance is a crucial financial product that provides protection and peace of mind to individuals, families, and businesses in Lafayette, TN. It serves as a safety net against unexpected events such as accidents, natural disasters, or health emergencies. The history of insurance services in Lafayette, TN dates back many years, with various insurance companies offering a wide range of coverage options to meet the diverse needs of the community. Common types of insurance available in Lafayette, TN include auto insurance, home insurance, health insurance, and life insurance.

Local Insurance Providers

In Lafayette, TN, residents have access to a variety of insurance providers offering different services and coverage options. Some key insurance companies operating in the area include ABC Insurance Agency, XYZ Insurance Services, and 123 Insurance Solutions. Each insurance provider has its own unique offerings and pricing structures, catering to the specific needs of their clients. Before choosing an insurance provider, it is important to compare and contrast the services, reputation, and customer reviews of each company to ensure you are getting the best coverage for your needs.

Insurance Coverage Options

Residents of Lafayette, TN have a wide array of insurance coverage options to choose from based on their individual needs. Common insurance policies offered in the area include auto insurance to protect vehicles from accidents and theft, home insurance to safeguard homes and belongings from damage or loss, health insurance to cover medical expenses and treatments, and life insurance to provide financial security to loved ones in the event of death. When selecting insurance coverage, factors such as coverage limits, deductibles, premiums, and exclusions should be carefully considered to ensure adequate protection.

Insurance Regulations in Lafayette, TN, Lafayette tn insurance

Insurance companies operating in Lafayette, TN are subject to a regulatory framework that governs their operations and ensures consumer protection. Specific laws and regulations impact insurance policies in the area, including requirements for minimum coverage levels, claims processing procedures, and licensing requirements for insurance agents. These regulations aim to maintain fair and transparent practices within the insurance industry and protect the rights of policyholders. Comparing insurance regulations in Lafayette, TN to other regions can provide insights into how the local market operates and the level of protection offered to consumers.

Final Conclusion

In conclusion, Lafayette TN Insurance is not just about protection; it’s about peace of mind and security. By understanding the local providers, coverage options, and regulations, residents can make informed decisions to safeguard their assets effectively.

Popular Questions

What are the key insurance providers in Lafayette, TN?

Some key insurance providers in Lafayette, TN include XYZ Insurance Agency and ABC Insurance Company.

What types of insurance are commonly offered in Lafayette, TN?

Common types of insurance offered in Lafayette, TN include auto insurance, home insurance, and health insurance.

How do insurance regulations in Lafayette, TN compare to other regions?

Insurance regulations in Lafayette, TN are similar to other regions but may have specific laws that impact insurance policies in the area.