Ohio insurance rates are influenced by various factors like demographics, driving record, and coverage types. Let’s explore how these elements impact insurance costs in the state.

Factors Affecting Ohio Insurance Rates

Demographic factors such as age, gender, and location play a significant role in determining insurance rates in Ohio. Younger drivers are typically charged higher premiums due to their lack of experience on the road. Gender can also impact rates, with statistics showing that male drivers tend to be involved in more accidents than female drivers. Additionally, the location where the insured individual lives can affect rates, with urban areas often having higher premiums.

Driving record, credit score, and claims history are other crucial factors that influence insurance premiums in Ohio. A clean driving record with no accidents or traffic violations can lead to lower rates, while a poor record may result in higher costs. Similarly, individuals with a higher credit score are seen as less risky and may receive lower premiums. Claims history, including the frequency and severity of past claims, can also impact insurance rates.

The type of coverage selected by policyholders can also affect insurance rates. Comprehensive coverage that includes protection against a wide range of risks will typically cost more than basic liability coverage. Policyholders should carefully consider their coverage needs and budget when selecting a policy to ensure they are adequately protected at a reasonable cost.

Comparison of Insurance Providers in Ohio

Several major insurance companies operate in Ohio, offering a variety of coverage options to consumers. Some of the prominent providers include State Farm, Nationwide, Progressive, and Allstate. Each company has its own pricing structure and discounts, so it’s essential for consumers to compare rates before choosing a provider.

When comparing insurance rates in Ohio, consumers should consider the average premiums offered by different providers for similar coverage. Factors such as deductibles, limits, and additional services can all impact the overall cost of insurance. Customer reviews and satisfaction ratings can also play a crucial role in influencing insurance provider choices, as positive experiences with an insurer can lead to long-term customer loyalty.

Strategies to Lower Ohio Insurance Rates

Policyholders can take several steps to potentially lower their insurance rates in Ohio. Qualifying for discounts, such as safe driving discounts, multi-policy discounts, or bundling discounts, can help reduce premiums. Bundling insurance policies with the same provider, such as combining auto and home insurance, can also lead to cost savings.

Increasing deductibles is another strategy that policyholders can consider to lower insurance premiums. By opting for a higher deductible, individuals can reduce their monthly premiums, though they should be prepared to pay a higher out-of-pocket amount in the event of a claim. Policyholders should weigh the potential savings against the increased financial risk before adjusting their deductibles.

Trends in Ohio Insurance Rates

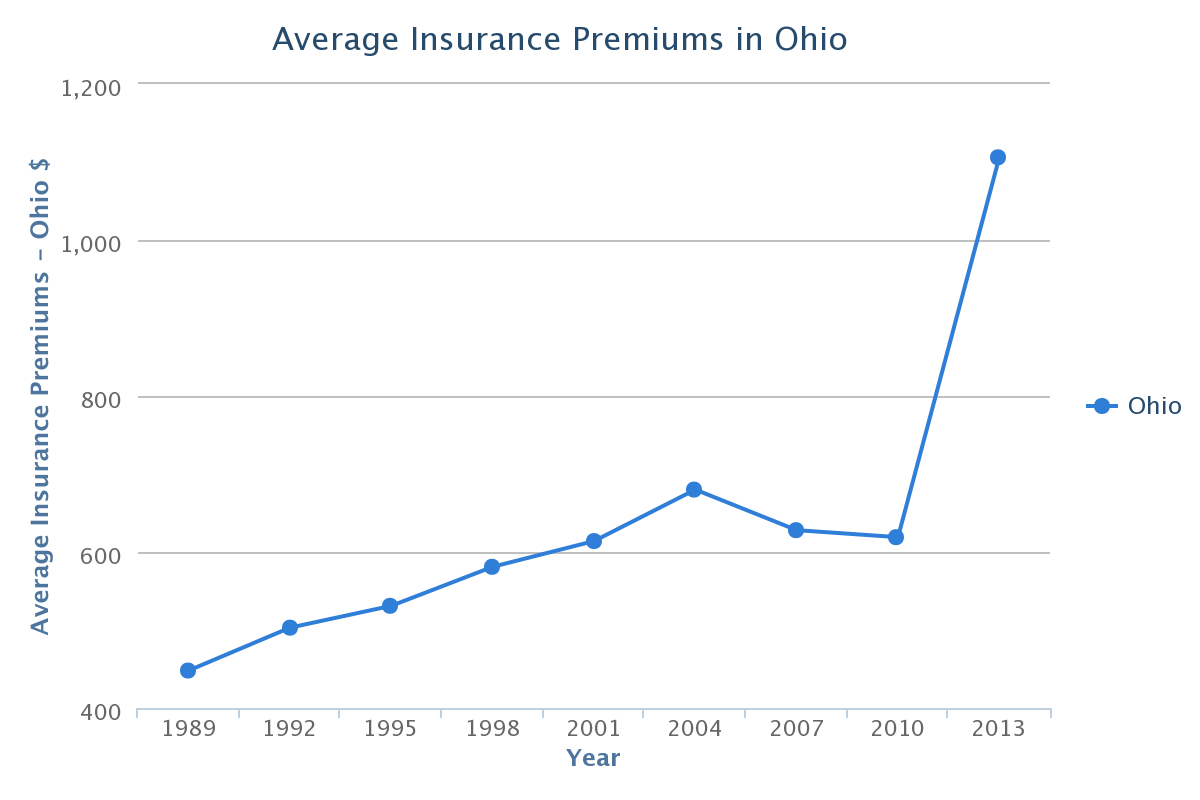

Analyzing historical data reveals how insurance rates in Ohio have evolved over the past decade. Fluctuations in rates can be influenced by factors such as changes in the economy, advancements in technology, and shifts in consumer behavior. It is essential for insurance companies to stay informed about emerging trends and adapt their pricing strategies accordingly.

Looking ahead, emerging factors such as climate change, autonomous vehicles, and regulatory changes are likely to impact insurance rates in Ohio in the future. Insurers must remain proactive in monitoring these trends and adjusting their pricing models to reflect the evolving risk landscape. External factors beyond the control of policyholders can significantly influence insurance pricing, making it essential for insurers to stay agile and responsive to change.

Conclusion: Ohio Insurance Rates

In conclusion, understanding the factors affecting Ohio insurance rates, comparing different providers, implementing cost-saving strategies, and staying informed about trends can help individuals make well-informed decisions when it comes to their insurance needs.

Frequently Asked Questions

How do demographic factors affect Ohio insurance rates?

Demographic factors like age, gender, and location play a significant role in determining insurance rates in Ohio. Younger drivers or individuals living in high-risk areas may face higher premiums.

What are some tips to lower Ohio insurance rates?

To lower insurance rates in Ohio, policyholders can qualify for discounts, bundle policies, or consider increasing deductibles. These strategies can help reduce overall costs.

How have Ohio insurance rates changed over the past decade?

Historical data analysis reveals how insurance rates in Ohio have fluctuated over the years, impacted by various economic and regulatory factors. Understanding these trends can provide insights for future decisions.